CRM systems are now a must-have for virtually any business in any industry – and banking is no exception. As traditional financial institutions compete with the new kids on the block, fintechs, they strive to meet ever-growing customer expectations while still being efficient.

And CRMs do help with that – they facilitate stronger customer relations, optimize customer-facing processes, and improve operational performance, among other things. After all, when 47% of businesses claim that CRM software has massively improved their customer retention, we probably need to say no more about its benefits.

But what does a CRM in banking actually do? And how to pick the best fit for your bank?

In this article, we’ll answer these questions and more – we’ll explore the challenges banks face when implementing CRM systems and also highlight the best CRM options specifically designed to address the banking sector.

What is a CRM in the Banking Industry?

So what is CRM in banking? CRM in the banking sector allows banking organizations to build a customer-focused business framework to understand the customer’s needs and demands and, more importantly, meet them with your banking and financial services.

Just like any organization’s success, high customer satisfaction and retention are critical for a bank’s success in today’s competitive market scenario. According to a study by Reichheld and Sasser, banking businesses can observe an improvement in the profit margins by up to 35%, just from the 5% growth in customer retention rate.

Challenges of CRM in the Banking Industry

Just like any other business, banks face several challenges when looking to adopt CRM software.

Data Security

The banking industry is very sensitive to data security and aims to deliver an extra level of control over access to their records. Besides their clients’ personal information and account records, the entire banking system should be well protected against cyber-attacks and malicious software. Modern CRM banking platform providers are well aware of these concerns and provide excellent security measures, from role-based access permission to encrypted transactions and data backups, to ensure a high level of information security.

Integration with the Existing Tech Stack

Pretty much every financial and banking organization has a legacy IT infrastructure and tech stack that might be complicated to interfere with. Most of the outdated software wasn’t built to work together with the modern CRM systems. It means that any bank can face the problem of integrating new solutions with the existing ones without any data loss and system failures. The good news is CRM specialists such as OMI can help you seamlessly integrate a CRM system of your choice into your company’s infrastructure and make sure the new solution works perfectly.

Implementing CRM in banking industry brings a unique set of challenges. Unlike other industries, financial institutions face layers of regulatory complexity, legacy infrastructure, and customer expectations that demand high-level sophistication in every interaction. Below are the core issues banks encounter when adopting CRM banking solutions.

Regulatory Constraints and Data Privacy

Banks operate under some of the strictest regulatory frameworks in existence. That’s why a poorly implemented CRM can easily expose banks to significant legal risks, particularly in managing sensitive personal data. Thus, CRMs must be equipped not only to store and retrieve customer data but also to handle audit trails, encryption, and other compliance mechanisms.

Customer Trust and Engagement

Today’s customers, in banking or otherwise, expect very personalized service and lightning quick problem resolution. So CRM solutions must take care of that as well – they must strike a fine balance between being informative and invasive, focusing on meaningful touchpoints with clients without overstepping their boundaries.

The Growing Threat from Fintech

As banks face competition from tech-driven financial startups, they must adapt – these newer players often start with a clean slate and a digital-first strategy, making them very agile in dealing with customers. Established institutions, on the other hand, are having to re-engineer their entire approach to customer relationship management in banking if they want to stay relevant.

Benefits of CRM in the Banking Sector

Both customers and banking organizations can benefit from using CRM. The first ones get more personalized high-quality services, while the second ones get better control of their operations and can deliver this type of service. Here are the main benefits of CRM in banking, according to our experience:

Get and Qualify More Leads

CRM banking systems help you to reach out to your leads as quickly as possible to either help them with their challenges or understand that your service is not what they are looking for. As a result, the lead qualification process is sped up and your sales department can focus on converting leads into actual sales.

Centralized Customer Data

You can consolidate all of your customer data (transaction histories, inquiries, preferences, behavioral trends, etc) into one platform, which allows you to develop a deep understanding of each customer’s financial situation.

Targeted Marketing

As an extension of the point above, you can launch very targeted marketing campaigns with a personalized message to increase your customers’ engagement and satisfaction rates – make them get what they need and when they need it. Your clients will appreciate your care and attention.

Improve Staff Productivity

CRM in banking sector helps to streamline processes across various departments, as well as to eliminate repetitive tasks, and let your staff focus more on clients and improve their performance.

Get Valuable Insights

The system analyzes data on your customers’ behavior such as chosen types of credit and debit cards, number of transactions, type of transactions, etc. This data can be later used by your sales and marketing departments to improve your services.

Drive New Business Opportunities

Every industry needs to keep up with the constantly changing economy and market demands. Analyzed customers’ data can be used to introduce new solutions to fulfill your clients’ needs. As a result, your business credibility, loyalty, and awareness increase letting potential customers know that they can trust your organization.

Operational Efficiency

CRM systems automate routine tasks, significantly reducing operational costs. For instance, by automating customer data entry and transaction logging, banks can free up valuable employee time to focus on more complex customer needs. CRMs also centralize customer information, which enables banks to respond to customer inquiries more swiftly, resolve issues faster, and capitalize on cross-selling opportunities more effectively.

Compliance and Risk Management

CRM systems ensure that banks adhere to stringent legal and regulatory requirements by tracking and managing compliance tasks and deadlines. Additionally, they help analyze customer data and transaction patterns, so that banks can identify potential risks early on, such as suspicious activities or non-compliant behaviors.

How to Choose the Right Banking CRM?

Selecting the right CRM for a financial institution is way more difficult than browsing websites and choosing a product that looks good on paper. Here are some key factors to consider:

Customizability to Fit Banking Needs

Your CRM should not just be off-the-shelf software but must be adaptable to your bank’s unique service models. Every bank has different requirements based on its size, region, and focus – and the CRM should allow for deep customization to meet those requirements.

Integration with Core Banking and Other Systems

CRM systems for banking must integrate easily with a variety of legacy systems, including core banking software, risk management tools, and customer support platforms. So make sure that the CRM of your choice offers API support or connectors for smooth data exchange between the various systems you have in place.

Data Security and Compliance Features

Unsurprisingly, any CRM for the banking sector must also meet the highest standards of data encryption and cybersecurity. And what’s more, the system should have built-in features to manage compliance – audit trails, data masking and permissions-based access control.

Analytics and Reporting

A proper CRM solution should offer you robust analytics that don’t just track sales – predictive analytics and machine learning can provide your bank with insights into customer behavior, help detect fraud, and find opportunities for cross-selling and upselling.

5 Best Banking CRM Software: Our Top Picks

Salesforce

Salesforce Financial Services Cloud is a great solution for banks that value flexibility and strong integrations. In practice, this means it can not only handle your customer interactions but also integrate your data across multiple divisions, from retail banking to wealth management.

Salesforce also offers predictive analytics and AI capabilities through its Einstein AI engine, which can massively help your bank to make your services more personalized.

However, Salesforce’s implementation cost can be a concern, particularly for smaller banks. And it also comes with a steep learning curve due to its vast feature set, often calling for specialized teams of Salesforce experts to manage and customize the system.

Creatio

Creatio’s Financial Services platform is known for its no-code customization, which allows banks to improve their workflows without needing extensive IT support. Creatio also shines in automation, making it easier for banks to digitize operations like account opening, loan origination, and customer onboarding. The platform’s integration capabilities are also solid, with its tools for connecting to core banking systems and third-party applications.

Microsoft Dynamics 365

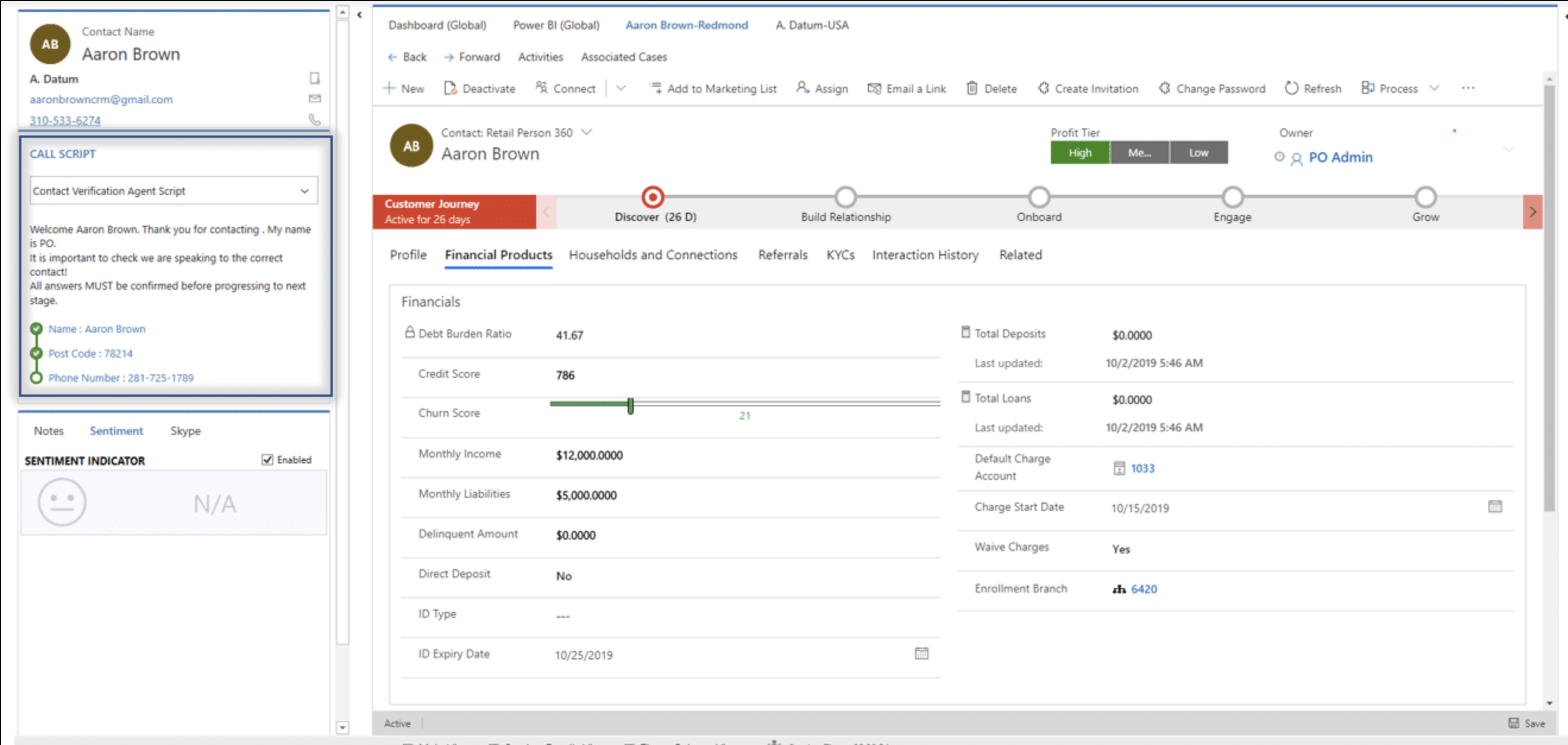

Microsoft’s CRM for Financial Services takes full advantage of its extensive ecosystem, particularly Azure and Power Platform, to make itself another powerful solution. If you are already using Microsoft’s suite of tools, this CRM will offer you a very familiar interface and strong interoperability on top of its 360-degree view of the customer and AI tools.

One limitation is its pricing, which can add up quickly when incorporating multiple Microsoft products like Azure or Power BI. Additionally, Microsoft’s solution isn’t the most intuitive or easy to implement, that’s why banks often collaborate with certified Certified Microsoft Dynamics Specialists to get valuable help and insights.

Oracle

Oracle’s CRM is another contender with a strong focus on digital banking with its guided selling and personalized product recommendations. Oracle’s AI-powered lead management system will allow you to prioritize your opportunities and vastly improve your onboarding and account origination processes.

However, Oracle CX can fall short in areas like investment and wealth management, making it a less suitable choice for banks that rely heavily on these services.

Pegasystems

Pegasystems excels in automating repetitive processes and is no short of AI-powered customer interaction tools either. Its ability to unify marketing, sales, and service makes it particularly effective for banks with complex, multi-departmental needs.

That said, Pegasystems’ focus on enterprise-level organizations makes it a less appealing choice for smaller banks as they may find the system over-engineered for their needs.

CRM Solutions for Banks

OMI provides one of the best CRM services for banks and financial institutions and offers customizable solutions to make sure their functionality perfectly aligns with your organization’s needs.

Salesforce for Banks

Salesforce is a good example of CRM in banking as it offers a great number of tools and services that can be used across banking organizations for process management and team collaboration.

Salesforce allows banks to gain a complete view of each client by unifying all your banking operations – in-branch as well as digital channels. Third-party integrations give you endless possibilities to build sophisticated task management systems for sales, marketing, and customer service that can help your bank increase process efficiency.

Process automation in the banking sector is essential to eliminate many tedious tasks that are essential to reduce operations costs, improve work efficiency, and gain more clients faster. Salesforce comes with a Marketing Cloud module, that allows you to manage everything from marketing intelligence to customer retention, and community engagement, for a centralized platform.

Salesforce consultants at OMI help you evaluate your business state and challenges and pick the right CRM configuration.

Microsoft Dynamics 365 for Banks

Microsoft Dynamics 365 is another great CRM solution that features a variety of tools for all kinds of business needs, from internal process management to customer engagement.

Microsoft Dynamics 365 along with the “Banking Accelerator” feature, allows banks to quickly develop intelligent financial services and innovative solutions powered by industry-standard data models. This data-driven “Banking Accelerator” helps banks to offer an improved banking experience – that helps them to stand out from their competitors and boost customer acquisition, loyalty, and retention.

Communication process automation and customer insights help banks to offer customized deals and personalized experiences for financial services. Positive customer experiences directly impact long-term customer relationships that result in higher retention rates and accelerate business growth.

OMI can help your organization implement MS Dynamics and power up your teams with full-feature tools to help your company grow. Make sure to reach out to one of your specialists and we’ll be glad to discuss your project in more detail.

OMI CRM Solution For Banks

To finish our guide off, we’d like to suggest our team’s professional vision of a perfect CRM banking solution – rooted in our 25 years of experience. While all the aforementioned candidates are worthy considerations, our preference lies in the most powerful ones – Salesforce and Microsoft Dynamics.

Many solutions can provide all the essential infrastructure for managing customer relationships, optimize your internal processes and help you maintain compliance. But what ultimately sets these two apart is their amazing integrations and sheer power of functionality on offer – and you will never regret implementing one of them for your bank.

At the same time, while you can do it yourself, you may benefit way more from collaborating with a Certified CRM Expert like OMI. We boast almost three decades of experience under our belt – and we will make all the theoretical Salesforce features and benefits become reality.